(Thread IKs:

skooma512)

|

SourKraut posted:Then again: Pompeii. Check-loving-mate.

|

|

|

|

|

| # ? May 23, 2024 08:02 |

|

Xaris posted:not necessarily. the the "good ol' days" auto-loans were between 36-48-60 month, usually you were paying them off above or at depreciation. most of the time depreciation was significant in the first year or two and then tapered off returning to positive equity. usually stupid luxury blinged-out Sports XL Turbo with all bells & whistle trims would be underwater immediately because they're also dropping $$$$$ bucks for no/little used market value. depreciation isn't what it used to be for sure, that's one weird part about the calculation is that while the loans have become longer, cars retain their value for longer too. you're not buying a 3 year old car for 40% under its original MSRP anymore, at best that 3 year old car with 50k miles on it might be 10-15% under original MSRP.

|

|

|

|

Shipon posted:cars retain their value for longer too. you're not buying a 3 year old car for 40% under its original MSRP anymore, at best that 3 year old car with 50k miles on it might be 10-15% under original MSRP. honestly it depends on the type. i.e. Toyotas/Honda, particularly priuses, can be like 2011 w/ 200k miles and resell for like 90% of original MSRP. because they're super popular with gig app drivers and meme cars. It gets even worse for things like Leaf which used to retail for like 12k new MSRP with the early-day EV fed rebates and now still sells for like 14k used because hybrids/electric cars have become hugely in-demand, again, particularly with gig workers. likewise Subaru base models, even over a decade old, will still sell for like 80% because they've also become kinda a conventional wisdom reddit meme car. white Nissan Altimas are also super popular used cars and ridiculous how much they sell for used. blinged out domestic Ford/GM SUVS with luxury trim poo poo that retailed for like 55k back in 2015, no. mitsubishi, kia, hyundai, etc, all have very very bad used value except for base-trim sedans and even those are like, no. people are not blowing big bucks to buy some 2013 Ford Escape Sports LX pro-max-HD heated seats for more than maybe 10k maximum. which is still a shitload of money for a 10-year old car, but massive depreciation compared to original retail price. if it was base trim, yeah the one exception is domestic trucks are still absurdly stupid for used market because america loves truk e: i suppose stated another way: there's a weird artificial floor on used car prices of like ~7k-10k no matter how old or dogshit beat up they are (within reasonable service life); but, there is also a ceiling on used car prices that generally aren't more than 24k used. And certainly after the pandemic bonanza, the floor went up a loving lot and simultaneously the ceiling went up as well but not as much as the floor went up. So there's a rather narrowly band of very over-inflated cost associated w/ used cars, and how much that depreciation hits (or gained value) really just depends on how much you bought for new. so like there were certain cars you coulda easily bought for 10k-22k new (or used) in 2019 that actually gained value in 2020-1 -- which may be the first time in history that's ever happened Xaris has issued a correction as of 08:32 on Mar 20, 2023 |

|

|

|

We love the gently caress out of truck

|

|

|

|

Gold up to a 1 year high at over $2k an ounce Also VIX is creeping up towards that "we're freaking out here" number of 30. 28.26 just now. forkboy84 has issued a correction as of 08:39 on Mar 20, 2023 |

|

|

|

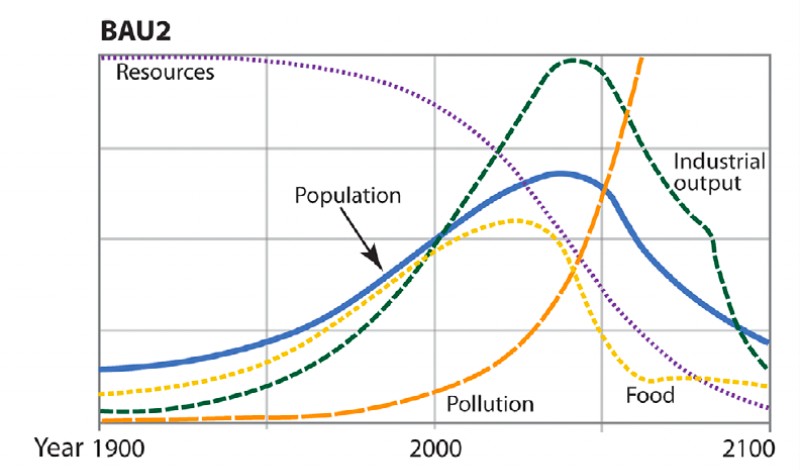

Xaris posted:indeed. in the early 1970s, MIT did LtG modelling predicting big decline around 2040, and empirical observations, 50 years later, to 2020 are remarkably on track. love that pollution keeps going even as everything else drops Bitcoin forever

|

|

|

|

Xaris posted:i cant remember if this was posted or not but big shocked pikachu face There was that tidbit about a $1b Subprime auto sale from Santander being cancelled in relation to SVB failing lol https://www.bloomberg.com/news/articles/2023-03-15/santander-halts-942-million-subprime-auto-abs-sale-amid-turmoil lmao fanfic insert has issued a correction as of 08:51 on Mar 20, 2023 |

|

|

|

someone just murdered a landlord during an eviction in Honolulu and that actually happens a lot here. last time it happened the evictee also murdered two cops, and also burned down an entire city block

|

|

|

|

Stereotype posted:someone just murdered a landlord during an eviction in Honolulu and that actually happens a lot here. last time it happened the evictee also murdered two cops, and also burned down an entire city block  that's the aloha spirit reclaim hawai'i from the landlords

|

|

|

|

European bank stocks down an average 3.4% so far, UBS shares are down more than 12%.

|

|

|

|

hee hee hee

|

|

|

|

can't believe i got held up with work the day fucken credit suisse "died"

|

|

|

|

bet those last 500 posts were good content OH WELL I'LL NEVER KNOW

|

|

|

|

looks like the stocks are going past the bisquick threshold, hold on tight fellas

|

|

|

|

Lessail posted:looks like the stocks are going past the bisquick threshold, hold on tight fellas The qhat now

|

|

|

|

Good morning European stocks are paring some of their losses after plummeting at the bell, but the Europe 600 Banks index is still down 2.5% with UBS leading the way, down over 10% After losing a cool billion in almost record time the Saudi National Bank is saving face: https://twitter.com/FirstSquawk/status/1637705135773171713 US Markets and commentators are betting the PIVOT is here https://twitter.com/FirstSquawk/status/1637706273461501952https://twitter.com/lisaabramowicz1/status/1637738875073200128 but European regulators remain hawkish (at least in their language) https://twitter.com/financialjuice/status/1637719971559092224https://twitter.com/FirstSquawk/status/1637714877086158849

|

|

|

|

what does this mean for the future of NEOM

|

|

|

|

JAY ZERO SUM GAME posted:what does this mean for the future of NEOM Neom fulfilled his destiny by returning to the source and resetting the matrix

|

|

|

|

Angkor wat was never abandoned. except during war iirc.

|

|

|

|

The market sceams for pause

|

|

|

|

Xaris posted:

|

|

|

|

Mr Hootington posted:The market sceams for pause

|

|

|

|

*mashes both buttons*

|

|

|

|

markets pricing in rate cuts feels like crazy pills. Is it possible the flight to safety of bonds is implying a rate cut, like, accidentally? just a side effect of people panicking about banks, taking out deposits, using cash to buy bonds, and driving up prices (thus lowering yields)?

|

|

|

|

The Fed specifically said they would not cut rates in 2023, but the market is addicted to free money.

|

|

|

|

maybe they can cut rates just for those who really need it? banks and REITís for example.

|

|

|

|

https://twitter.com/patio11/status/1637602924686901249 https://twitter.com/patio11/status/1637604177429012482 anyone insane/rich + liquid enough to try this? seems like giving banks money during a bank run might just work

|

|

|

|

Digging into the write-off of $17 billion CS AT1 Bonds Headlines on Sunday leading up to the UBS deal, each only hours apart:    and Bloomberg on the terms:    quote:https://twitter.com/business/status/1637753888647380994https://twitter.com/TruthGundlach/status/1637624970754015234https://twitter.com/CasinoCapital/status/1637552246622760960 https://twitter.com/SofiaHCBBG/status/1637691968494112768 EU regulators suggesting this should not be a new precedent: https://twitter.com/BondHack/status/1637774675118809088

|

|

|

|

Let's not exaggerate. Things are totally fine. Jpow just let an entire economy develop around zero interest only to push us to the brink of hyperinflation printing over a recession to then have to raise rates so high, but nowhere near high enough, in an attempt to wipe out workers that this threatens the entire economy but because it was threatened too much too fast we need to go back to printing over whatever is happening. it makes perfect sense to me as an expert number knower. You just identify a massacred workforce of poors with no assets as having too much money. Because workers drive inflation by getting money. It's right there in the text book. Then you maliciously target these people with financial moves until your own dumb loving quadrillion dollar house of cards the rich have built on top of the economy is threatened. You fix this by hitting the "PRINT MONEY" and "RAISE RATES" buttons in quicker succession to get more bang for your buck. It's the classic surgical sledgehammer approach. Just tape a scalpel to a couple of sledgehammers. This will allow for unparalleled precision force.

|

|

|

|

I bet if the WOKE banks were to revalue the Dinar then all the liquidity issues would just evaporate

|

|

|

|

webcams for christ posted:Digging into the write-off of $17 billion CS AT1 Bonds this is nearly as funny as that mayor in south korea singlehanded destroying their municipal bond market by refusing to pay the bond holders back for a theme park

|

|

|

|

Inshallah, the junk bond market collapses today.

|

|

|

|

Credit Suisse that is open in the European markets is down roughly 60% today. The NYSE traded version is down 60% in pre-market. Curious how this will affect the bailout.

|

|

|

|

We're not in a recession https://twitter.com/LizAnnSonders/status/1637769197932494849

|

|

|

|

we need a bailout to cover those investors and then things will be perfect again until next weekend again

|

|

|

|

Rectal Death Adept posted:Credit Suisse that is open in the European markets is down roughly 60% today. The NYSE traded version is down 60% in pre-market. currently at 0.76 CHF / share. The final buyout price that UBS agreed to was 0.75 CHF / share (initial offer was 0.25 / share lol). it will be notable if it's trading significantly below or above that number.

|

|

|

|

Rectal Death Adept posted:Credit Suisse that is open in the European markets is down roughly 60% today. The NYSE traded version is down 60% in pre-market. It won't, those numbers are just converging toward the agreed purchase price (which was way lower than Friday's closing price) until the deal formally closes.

|

|

|

|

the car situation is so bad, cars are so expensive now and people with low credit scores are missing payments at record levels: https://www.axios.com/2023/03/01/low-income-households-are-falling-behind-on-car-bills err has issued a correction as of 13:17 on Mar 20, 2023 |

|

|

|

it goes it goes it goes it goes it goes GUILLOTINE HYUH

|

|

|

|

|

| # ? May 23, 2024 08:02 |

|

those are the same button

|

|

|