(Thread IKs:

skooma512)

|

|

|

|

|

|

| # ¿ May 10, 2024 21:39 |

mastershakeman posted:So did that guy who bought sbv stock make the right call No. SVB is dead. Their stock is worth $0.00.

|

|

|

|

anime was right posted:if anyone has good content for the OP lmk https://i.imgur.com/CGAN1Md.gifv

|

|

|

|

|

enhance and diversify deez nuts https://twitter.com/Fxhedgers/status/1635067459358314496

|

|

|

|

Hubbert posted:black monday the 13th

|

|

|

|

|

I hope everyone enjoyed this episode of Infrastructure Week -- National Finances Edition.

|

|

|

|

|

Italian finance bro pointing out the USA is repeating a lot of the same mistakes Italy did when they went through their own financial crisis: He thinks the only real fix is to forcibly raise deposit rates: quote:https://twitter.com/gianlucac1/status/1634462490468794378

|

|

|

|

|

This guy says this is gonna trigger a wave of people moving money into big banks instead of having it spread out. https://twitter.com/PauloMacro/status/1635091004566167553

|

|

|

|

Mr Hootington posted:Barney Frank himself was on Signature's board  LOL LOL

|

|

|

|

Mr Hootington posted:This was such a monumental mistake that will have unforeseen consequences. So A. FDIC is unlimited insuring everyone regardless of deposit level, we are literally printing infinite money B. This infinite insurance gets rolled back at some point, people go "Oh gently caress the government is in serious trouble" and we get a mass panic

|

|

|

|

BRAKE FOR MOOSE posted:what would definitely trigger flight would be the fed just going lol and doing nothing, since it guarantees that anything above $250k is not safe, so you go to a bank where the world economy is hosed if it fails. I dunno why paying back depositors has the same effect if they do it by a "just this once, you silly goose" mechanism Because it costs money to hedge anything past $250k. If you knew the FDIC was gonna be good for it -- but not good for anything above X indeterminate amount of money -- why bother keeping your money in a small bank and hedging against the excess of the FDIC insurance with a X% chance of going bust when you could just keep your money in a large bank that had 0.x% chance of going bust?

|

|

|

|

euphronius posted:I guess 6% inflation is the new floor Good thing Social Security has annual cost-of-living adjustments.

|

|

|

|

|

Ryan Maue is a rightoid who worked for Cato. He's mocking the climate companies.

|

|

|

|

Ackman hitting the catnip again.quote:This was not a bailout. During the GFC, the govít injected taxpayer money in the form of preferred stock into banks. Bondholders were protected and shareholders were diluted to varying degrees. Taxpayer money was put at great risk. Many people who screwed up suffered minimal to no consequences. Those were bailouts.

|

|

|

|

|

"Three... or possibly four" Wells Fargo is a problem.

|

|

|

|

WrasslorMonkey posted:Woah woah woah woah hold the gently caress on. It's a regional thing.

|

|

|

|

|

Bitchcoin is up 11.3%. All is well. Infinite bull market

|

|

|

|

|

The 75 point rally on futures from yesterday's bailout has already vanished. Bank stocks are getting blown out in premarket trading.

|

|

|

|

Jon Irenicus posted:Jim what are you doing The overnight rally began dumping pretty much the instant he tweeted this stuff. He has a true gift.

|

|

|

|

|

Monday the 13th 2023, a date that will live in infamy

|

|

|

|

coelomate posted:we doing affirmations to wish this into existence now? "down -0.25%" ignoring that it's down 2.6% from the high of the overnight rally that came on the back of the FDIC declaring an end to insolvency, coming off a -1.5% dump on Friday.

|

|

|

|

|

-1% -3% from intrasession high

|

|

|

|

Mr Hootington posted:2 year treasurers yield is down .52BPS. This is because people are rushing to move money from equities into bonds.

|

|

|

|

|

2008: Banks have a liquidity crisis, Fed steps in to guarantee liquidity 2023: Banks have a solvency crisis, Fed steps in to guarantee solvency What happens now?

|

|

|

|

shrike82 posted:someone should benchmark an inverse skull.gif index We've been in a bear market for 14 months now.

|

|

|

|

|

Early but it doesn't sound like Brandon's telling us anything new. Just recapping the weekend https://i.imgur.com/RFzS1q6.gifv

|

|

|

|

|

https://twitter.com/DeItaone/status/1635265194594291716

|

|

|

|

|

FRC popped to $34 during the Brandon speech and is getting blasted to sub-$29 right now. It closed Friday at $81.76.

|

|

|

|

skaboomizzy posted:jim cramer just said Wells Fargo is in great shape

|

|

|

|

|

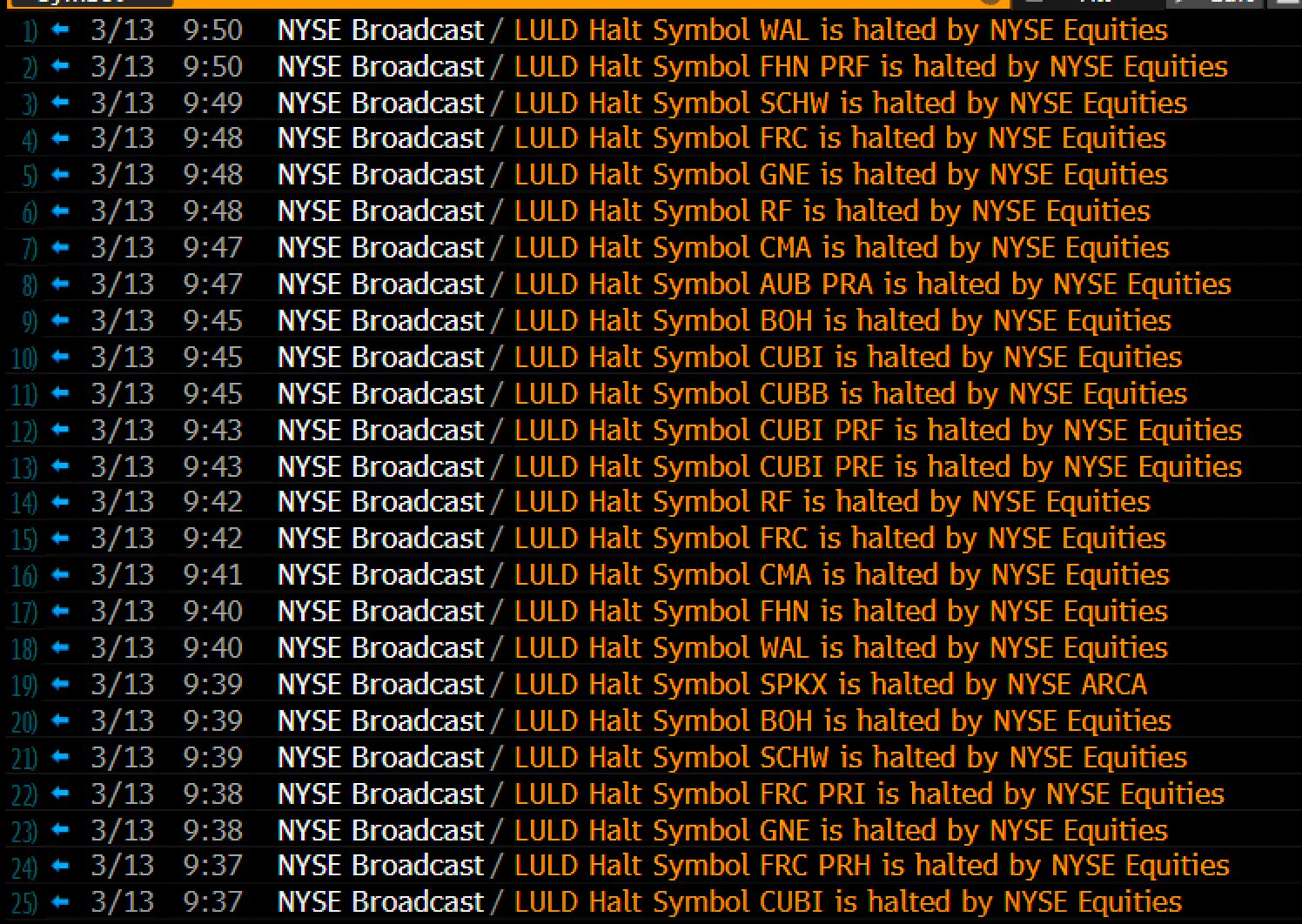

FRC trading instantly halted at open.

|

|

|

|

|

SCHW (Charles Schwab) halted as well.

|

|

|

|

Eric Cantonese posted:This seems pretty ridiculous as Schwab's business operations are apparently doing well and risk management seems good, but I'm not sure how it gets fixed without the pivot everyone is asking for. Have they been on the short seller target list for a while? This isn't an aftereffect of everyone being spooked about bank runs. SCHW began dumping on Thursday too along with the other banks that the market recognized as risky.

|

|

|

|

|

|

|

|

|

I have 2 separate boomers texting me asking me to explain wtf is going on. Everyone's spooked now.

|

|

|

|

|

SCHW on its 3rd halt, FRC on its 4th.

|

|

|

|

coelomate posted:That quote is from his newsletter on Friday March 10th 2023 It says in the image he's quoting himself from November.

|

|

|

|

|

|

|

|

Mr Hootington posted:People at my work are starting to talk and get antsy about this. I can overhear them saying ALL banks are having runs and are failing and people need to get their money out now. One of the boomers who texted me earlier scoffed when I explained the financial market was addicted to ZIRP and we're seeing insane withdrawal symptoms. He told me he bought a house at 17% interest and then refinanced to 13% in the early 1980s and then sneered at the markets for not being able to handle 5% interest.

|

|

|

|

|

Another bank gets frozen. https://twitter.com/zerohedge/status/1635280880771153920

|

|

|

|

|

|

| # ¿ May 10, 2024 21:39 |

Marx Headroom posted:its pretty funny that something is happening, but reporting on it would make it worse

|

|

|

|