|

GoGoGadgetChris posted:I just don't want my boys to miss the BIG gamble when results come in because they were dancing in and out of the daily volatility!!! When we gonna get options on this bitch?!

|

|

|

|

|

| # ¿ Apr 30, 2024 11:41 |

|

No options? No thanks

|

|

|

|

Asleep Style posted:Good news, Robinhood now allows you to buy fractional shares Gotta get on the waitlist first

|

|

|

|

Just bought 100 shares of AMD today to sell some slightly OTM calls on and now I'm hosed

|

|

|

|

Wallstreetbets on reddit

|

|

|

|

Save that money and buy GILD calls

|

|

|

|

Oscar Wild posted:REITs are going to be a graveyard until we start to see work unfreeze. I put too large of a % of my portfolio in REITs like a dumbass, can't wait to see how all this shakes out once they all probably go bankrupt. MFA already down 93% this month

|

|

|

|

Inner Light posted:Not quite -- up to $1k is available right away but the rest is a long window, for me it took 6 trading days until my transfer cleared. If you have Gold it increases the instant availability amount

|

|

|

|

poisonpill posted:Bluechips JNJ, GE, and T are all being kind to me today. The big question I have is, when are they going to crash again? I figure they will reach their ATH, or near that, before plunging again in the next few months. Does it make sense to pick a target to sell at, and then try to re-buy after another plunge? Timing the market is always a good idea

|

|

|

|

2890

|

|

|

|

Omerta posted:Something that some people consider in trading is unusual options volume. Having OTM options volume that exceeds open interest is notable and can suggest insider info or a position by one of the big boys. Same for large blocks of options bought shortly before expiration. There was also DoubleT2172 fucked around with this message at 22:15 on Apr 20, 2020 |

|

|

|

If it goes into negatives do they pay us to buy USO?

|

|

|

|

2694.20

|

|

|

|

mr.belowaverage posted:This is my question, too. You guys doing options, do you normally buy small priced items, like those for $1.08? A option is for a lot of 100, so it's $42 profit, cost to buy was $108

|

|

|

|

Sepist posted:Definitely going to $50 tomorrow. Down 12% already, RIP

|

|

|

|

I have a single share of TSLA and can't decide if I should sell or just ride it into valhalla

|

|

|

|

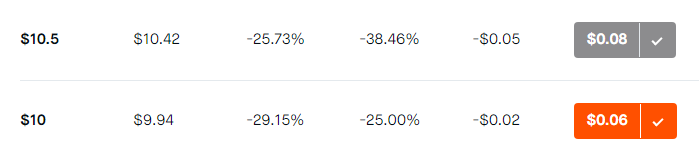

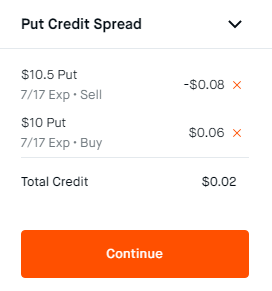

AHH F/UGH posted:I'm selling covered put credit spreads on high volume bullish stocks. High volume stocks are where you can find the most lottery tickets, you're lending money to people who are trying to hit a powerball jackpot. Sometimes they win, but you also take a smaller version of the same bet, so if you do lose, you can just pay them off with your own winnings from that slightly smaller jackpot. If the stock keeps going up and following its trend, you win regardless. If it goes sideways, you still win.

|

|

|

|

AHH F/UGH posted:Yeah actually that's correct I was forgetting about the 0.40x100 + premium part, it was just an example and I don't actually own that spread so I was eyeballing it. That said, if you have a high chance of winning, it's still worth it in the long run. I'm not sure what the chance of profitability is on those options. I get it but with the NIO example doing that weekly you can win 20 times then lose once and your gains are wiped out and it's a Chinese stock so we can't forget it could be pulling a Luckin or something and actually have that big a drop in a week

|

|

|

|

jokes posted:Selling options is a very cool and viable way of making money but the cash you need is absurd, and the people who are learning about them are the exact people who should never ever sell options because they will gently caress it up and end up owing hundreds of thousands of dollars because they're loving idiots on Robin Hood. And then kill themselves over the weekend when Robinhood's stupid rear end UI shows them -700k when that isn't true

|

|

|

|

Anyone throwing in on AAPL assuming the post split means it's going to hit an ATH due to Robinhood and others? Bought $10k in stock at $411ish on Friday

|

|

|

|

Alctel posted:Holy smokes I didn't realise that. Wow. My lender told me if I had bought the day I got pre-approved my rate would be 2.5% on a 30 year

|

|

|

|

WeBull is owned by China so I'd be wary with how the current administration is fighting Chinese tech

|

|

|

|

I bought both Tesla and Apple shares the day after the split announcement and it's been working so far but now I'm getting severe Ralph "I'm in danger" feelings since $10k that I used to buy the Apple shares was on margin with the intention to sell a covered call way out of the money but with enough premium to pay the interest and slowly pay the margin off but it's hard to not just sell 20 shares now and pay it off

|

|

|

|

NGC773 posted:TSLA please stop Shhhhh

|

|

|

|

Absolutely

|

|

|

|

ranbo das posted:Every share of PSTH has (at least) 2/9 of a warrant attached as well. Keep that in mind when trying to value it. How the hell does that even work?

|

|

|

|

pmchem posted:did you just unironically refer to a blank check SPAC -- with no announced target -- as a safe place to park money or am I missing some joke here BILL ACKMAN™

|

|

|

|

Oscar Wild posted:My goodness AAPL. hope I can buy tomorrow at this price. Why not just put in an extended market time order?

|

|

|

|

HMNY was my first investment. What a poo poo show

|

|

|

|

SnatchRabbit posted:Amd is back up to 92 and I’m considering getting out because I got in at like 20-30. Now that the new consoles and video cards and cpus are out I’m not sure it’s going to go any higher. Thoughts? Number can always go up

|

|

|

|

Cacafuego posted:I sold CSPs on PLTR $19 12/18 for $180 each 2 weeks ago. Just bought them out for $11 each. Made $169 on each Yes, Sell some 12/24 $30P

|

|

|

|

Harvest those losses to save on taxes!

|

|

|

|

drunken officeparty posted:When I first downloaded robinhood early this year Bitcoin was at $8000. I ignored it because bitcoin, but now Iím feeling like Iím back in 2011 making fun of Atlas and other teenagers saying how Libertarian Coin would crumble the idea of fiat currency Could you buy drugs online with Libertarian Coin? This is very important for my DD on if Bitcoin should be touched or not

|

|

|

|

Bored As gently caress posted:This kind of got missed on the last page, so I'll repost it. All I know is the pre the post the guy was supposedly holding 1/15 30C that he had paid $.70/contract for that were worth $.10 at the time of the post. I checked after he had got the interest drummed up and they were $.40/bid&$.50/ask. Real convenient way to get out without as much loss

|

|

|

|

Femtosecond posted:hah this is where I'm at too. I just try to ignore it. Wasn't that $190 at the pre split level too? So $38 at the stock price adjusted to today

|

|

|

|

I don't get how "BTC IS FOR ILLEGAL THINGS" is valid as a criticism when dollar bills are also used for illegal things all the time

|

|

|

|

cr0y posted:Non meme stock degenerate conversation: I am holding a couple $AMD 2/19 $13 calls and realized I don't know what to do with them with AMD reporting earnings Tuesday after close. If that's not a fat finger and you actually hold $13 calls that you (i assume at this point) got relatively cheap and didn't just buy when they were deep in the money, you call up your broker and say "I'd like to exercise these contracts" so you own 200 shares of AMD at a $13 cost basis

|

|

|

|

cr0y posted:That was a fat finger, sorry been in BB mode all day. $90 calls for AMD I'd just sell Tuesday before close and hope there is a run up to capture some extra IV exposure Mon and Tues. Though obvs you can get bit if they blow out earnings and go higher but that's always the risk

|

|

|

|

Inner Light posted:I am struggling to understand this, can someone please check my logic. Did this person spend $600 on a lottery ticket that paid off? The worst that could happen is they would've lost $600 right? This is correct, $6/contract, 98 contracts. So most he could have lost is ~$600. The deal though is 99.99999999% of the time those are expiring worthless. Dude got lucky. I mean you can too, but it really is basically playing the lottery when you do these 0DTE calls way out of the money

|

|

|

|

|

| # ¿ Apr 30, 2024 11:41 |

|

thats not candy posted:Yeah 0dte way outside the money calls like that are dirt cheap, you can pick up hundreds of them at a time usually but you're just throwing money away unless you know that squeeze is coming I have a feeling that 0DTE calls for GME on next Friday will be priced much higher due to this one paying off too lol

|

|

|